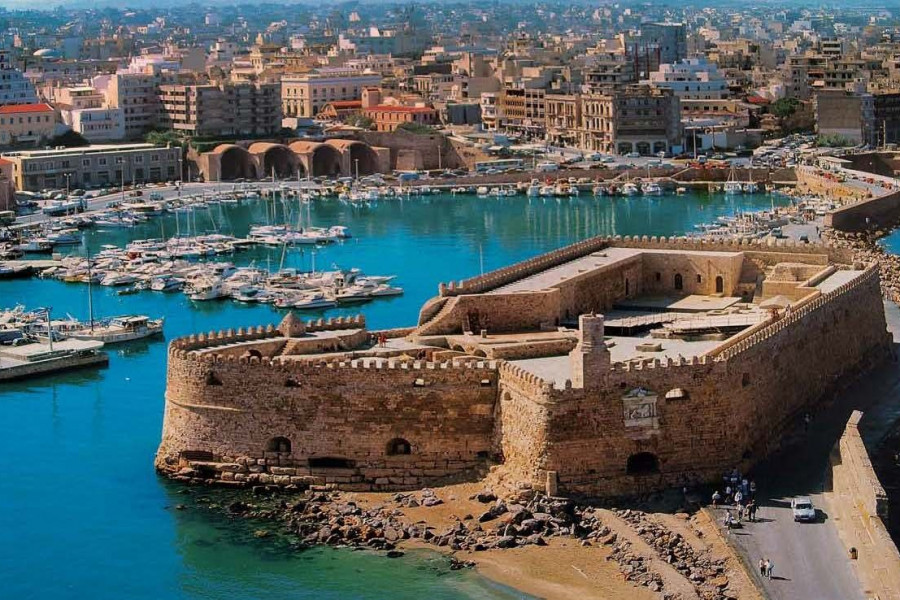

Beautiful Crete, with its wonderful Greek sun, its historic cities, its local treats and its legendary Cretan raki, attracts thousands of tourists each year and many of them yield to the temptation of making this love for the island official, by purchasing property in Crete: their own vacation home!

Worth knowing about Crete

Crete stretches over 8,303 square kilometers, full of local plants, different species of orchids and beneficial therapeutic herbs. The 1,046 kilometers of its shores are surrounded by the Cretan Sea, welcoming the island’s lucky visitors each summer.

The hospitable Cretans, 623,065 permanent residents with a population density of approximately 75/km2, offer a warm welcome to tourists and new residents who can’t wait to add their own numbers in the above figures, enticed by the largest island of Greece.

The island’s two airports and its multiple hotels accommodate visitors and they radically increase the island’s accessibility.

How is the Real Estate Market in Crete?

Although the financial crisis has deeply affected Greek economy, Crete’s real estate market still follows a dynamic course, in spite of adversity. Turning these negative conditions into opportunities, Crete offers the advantage of very competitive prices in comparison to other Greek islands.

In other words, Crete is the ideal solution for anyone looking for low-cost but luxurious property!

What types of properties can be found in Crete?

- Villas: Beside modern objects many objects are kept in the typical Greek style. The large estates are characterized by exceptionally beautiful locations

- Apartments: Luxury properties such as penthouses dominate the housing market. High-quality fittings and panoramic views over the city or the sea increase the value of the mostly new properties.

- Townhouse directly at the sea: Apartments in the centre of the 3 major Crete cities are indeed in great demand, as they offer excellent possibilities for subletting all year round.

What are the advantages of buying a property in Crete?

What is it that makes the purchase of property in Crete such an attractive option? Crete is like a mosaic of cultures and lifestyles: on your very first visit you can experience the island’s Venetian influences combined with Byzantine and Muslim ones. In this multifaceted island, you can feel free to choose between a more cosmopolitan lifestyle and absolute relaxation, coming in touch with nature.

A Greek beacon of culture, Crete is the birthplace of El Greco, Nikos Kazantzakis, and Odysseas Elytis. It’s home to some of the most magnificent natural landscapes in all Greece, with its towering Psiloritis and the dazzling beach of Elafonisi. An island with countless options for dining, drinking, entertainment or even water sports!

Northeastern Crete is undoubtedly the most popular side of the island, while the southeastern part boasts several unexploited areas, close to idyllic beaches and archaeological sites. Good news is that the real estate transfer tax is now lower than ever, so this should be no problem, bringing you one step closer to your goal. Still, German buyers are encouraged to be a little careful with the Land Registry process, which is a little different in Greece but in any case, the result will be totally worth it!

For the purchase of real estate property, the following are required:

- a valid passport

- a Greek tax identification number (AFM*)

- a certificate from the responsible tax office about the payment of the land transfer tax

What are the Costs and Taxes on Property Purchase?

The purchase costs & taxes for the purchase of property in Greece, are the following:

- Land register costs, imposed for the registration of the property at the land registry or cadaster office, amount to 1,0% of the fair value.

- Other costs such as the legal review of ownership (of at least around € 150) must also be considered.

- Real estate property transfer tax, which arises with the acquisition of real estate property or the acquisition of real rights upon property and is paid in principle by the buyer, before the notarial certification of the real estate property purchase. The current rate of land transfer tax is 3.09% of the purchase price.

- Notarization costs or notarial costs, always borne by the buyer, unless there is a different regulation. The basis of assessment used is the purchase price or the so-called unit value. Always apply the higher value. The certification costs are on average 1,5% plus VAT 24% of the underlying value.

More information about properties in Greece here.